2023 payroll tax withholding calculator

We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. Florida Hourly Paycheck and Payroll Calculator.

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

The Virginia income tax has four tax brackets with a maximum marginal income tax of 575 as of 2022.

. MSC01 1230 1 University of New Mexico Albuquerque NM 87131 Phone. Australia has a progressive tax system which means that the higher your income the more tax you pay. John and June Perovich Business Center 1700 Lomas Blvd.

The Payroll Office is responsible for the final payroll process that issues payment advices via direct deposit and payroll checks if applicable to all regular full-time part-time and temporary employees of the Prince William County School Board. Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022. FICA Federal income tax.

Non-resident Capital Gains Tax calculator added to the page. 1000 am - 200 pm Monday - Friday Payroll Department. PAYE tax calculator.

Rates and thresholds for employers 2022 to 2023. Calculating income tax in Australia is easy with the. This calculator is for 2022 Tax Returns due in 2023.

800 am - 500 pm Monday - Friday Window Hours. ICalculators Australia Tax Calculator provides a good example of income tax calculations for 2023 it includes historical tax information for 2023 and has the latest Australia tax tables included. This can sometimes take several weeksthe sooner you start the process the sooner youll have the tax account info required to pay them.

State regular employees who are otherwise eligible will receive an increment on July 1 2022 or January 1 2023 based on the employees entry-on-duty EOD date. How to calculate income tax in Australia in 2022. This is a more simplified payroll deductions calculator.

Annual calculations will also differ as tax offsets benefits and deductions are only applied at the end of the year. Payroll taxes are always deducted directly from each paycheck so you rarely have to pay additional payroll tax on your income tax return. We also offer.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Australia 2023 Tax Tables. Check your payroll calculations.

The salary calculator for income tax deductions based on the latest Australian tax rates for 20222023. NE Suite 3500 Albuquerque NM 87106 The. Aims to reduce the complexity of calculating how much to withhold and increase the transparency and accuracy of the withholding system.

If your EOD falls between July 1 and December 31 you will receive your increment in July 2022. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA. And access to up to the prior seven years of tax returns we have on file for you is available through 12312023.

The new W-4 system. This method of calculating withholding PAYG income tax instalments can vary from the annual tax amounts. All payroll is processed and paid on a semi-monthly pay period schedule.

The new W-4 is an attempt to be more accurate in estimating your tax withholding so that you can get closer to owing 0 and getting a 0 refund when you prepare your tax return. As a result many taxpayers are unaware of the true amount they pay in payroll taxes. Federal Payroll Tax Payment Frequency.

Washington registration and tax info Before you can pay employees make sure youve registered for payroll in their applicable work state. Know how much to withhold from your paycheck to get a bigger refund. Detailed Virginia state income tax rates and brackets are available on this page.

Pay dates are the last work day on or before the. The Australian Salary Calculator includes income tax deductions Medicare Deductions HEPS HELP calculations and age related tax allowances. Differences will always be in favour of the ATO however these will be refunded when the annual year tax return is processed.

Terms and conditions may vary and are subject to change without. The payroll tax consists of two halves - one half is paid by the employee and one half is paid by. We also offer a 2020 version of this calculator.

This includes a payroll tax credit and other stimulus measures.

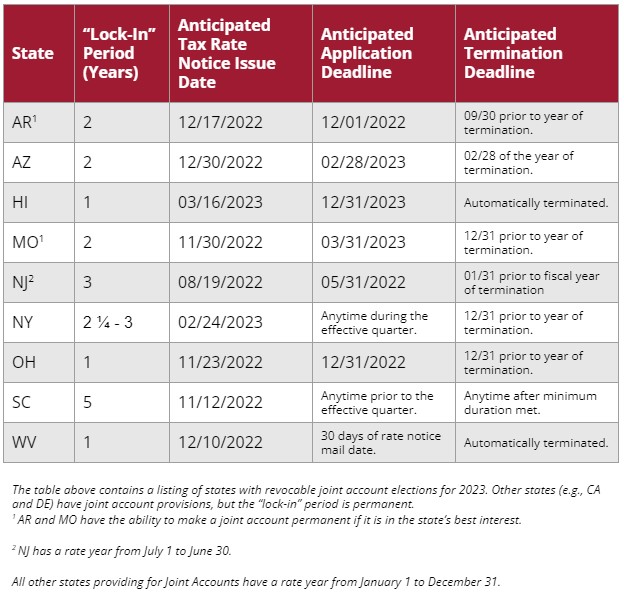

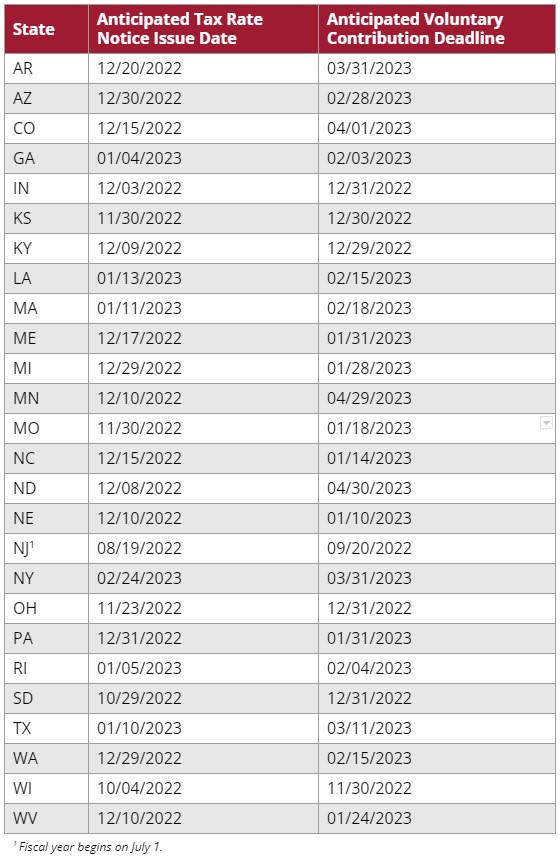

Strategies To Help Reduce Sui Tax Burdens In 2023 And Beyond

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Form 941 For 2023

Estimated Income Tax Payments For 2022 And 2023 Pay Online

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Tax Estimators For 2022 Returns In 2023 Estimate Your Taxes

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

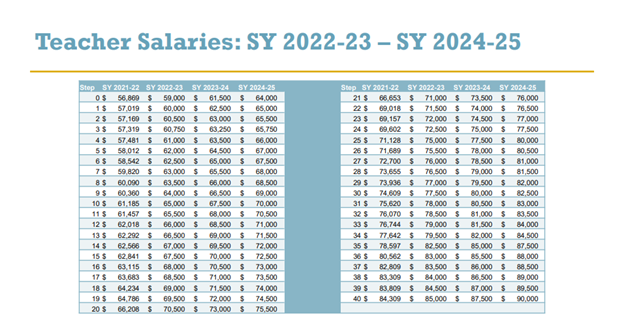

Hisd Announces Teacher Salaries Raises Through 2025 News Blog

Strategies To Help Reduce Sui Tax Burdens In 2023 And Beyond

2023 W 4 Form Professional Calculator And Pdf Online

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

2022 2023 Tax Brackets Rates For Each Income Level

Tax Withholding Estimator 2022 2023 Federal Income Tax Zrivo

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Social Security What Is The Wage Base For 2023 Gobankingrates