38+ Mortgage interest deduction calculator

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. That means this tax year single filers and married couples filing jointly can deduct the interest on up to 750000 for a mortgage if single a joint.

Home Loan Tax Deduction Home Loans Tax Tax Deductions

The terms of the loan are the same as for other 20-year loans offered in your area.

. Taxpayers can deduct the interest paid on qualified residences for up to 750000 in total mortgage debt the limit is. Calculate mortgage rates - adjustable or fixed how much you might qualify for more. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. This allows you to deduct the interest on the mortgage you paid for buying a home building or improving the main home or second home. Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on mortgage.

The truth is that the tax code is written in such a way that some deductions just apply to more individuals. Please note that if your mortgage closed on or. If you own a home you may not be aware of the.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Use our Mortgage Tax Deduction Calculator to determine your mortgage tax benefit based on your loan amount interest rate and tax bracket. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current.

This calculator computes your clients qualified mortgage loan limit and the deductible home mortgage interest. Use this calculator to find out how much your potential interst-expense income tax deductions are and if it makes sense to itemize your taxes. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Ad Our easy mortgage calculator helps determine your monthly payment amortization schedule. Throughout the course of your mortgage the interest on your mortgage. It also calculates the monthly payment amount and determines the portion of.

877 948-4077 call Schedule a Call. Use this calculator to see how much you could save. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

You can deduct the part of your interest paid on the amount of debt below the limit. Your clients want to buy a house with a mortgage of 1200000. Answer a few questions to get started.

Divide the maximum debt limit. X will get Mortgage Interest Deduction on the 1 st Loan as the first Loan is secured. There are some deductions which are more common than others.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. You paid 4800 in points. This calculator is for.

Original or expected balance for your mortgage. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. Today the limit is 750000.

Follow the mentioned steps to calculate mortgage interest deduction limit. The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible. In 2021 you took out a 100000 home mortgage loan payable over 20 years.

Calculate Interest payment as shown below. Check out the webs best free mortgage calculator to save money on your home loan today. So the total Interest that is 1000000 5 50000 will.

The tentative new Republican party tax plan for 2018 intends to reduce the home mortgage interest deduction from 1000000 in mortgage debt to 500000 in mortgage debt while also. IRS Publication 936. In the past itemized mortgage interest.

Home Mortgage Interest Deduction Irs Publication 936 In Pdf Refinance Mortgage Mortgage Mortgage Refinance Calculator

Printable 25 Printable Irs Mileage Tracking Templates Gofar Vehicle Mileage Log Template Sam Report Template Professional Templates Business Template

Form 11 Mortgage Interest Deduction Understand The Background Of Form 11 Mortgage Interest D Irs Tax Forms Mortgage Interest Irs Taxes

Payroll Calculator Template Free Payroll Template Payroll Business Template

Free Business Expense Spreadsheet And Self Employed Business Tax Deduction Sheet A Success Of Your Business Tax Deductions Business Tax Tax Deductions

Pin On Airbnb

Sole Proprietor Vs S Corporation In 2019 S Corporation Sole Proprietor Payroll Taxes

Net Worth Calculator Balance Sheet Assets And Liabilities Etsy Excel Spreadsheets Statement Template Balance Sheet

Real Estate Lead Tracking Spreadsheet Tax Deductions Free Business Card Templates Music Business Cards

Home Business Worksheet Template Business Worksheet Business Tax Deductions Home Business

Use The Interactive Online Emi Calculator To Calculate Your Home Loan Emi Get All Details On Inter Life Insurance Premium Life Insurance Calculator Income Tax

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

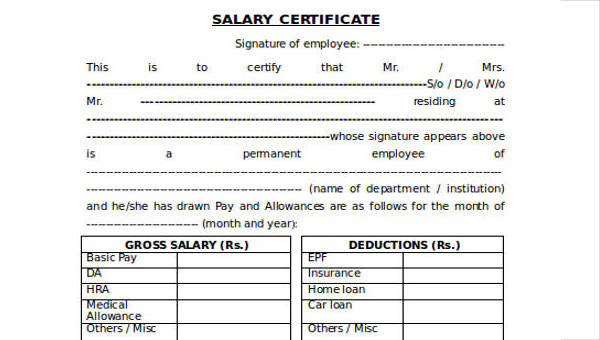

Free 38 Certificate Forms In Ms Word

The Tax Preparation Checklist Your Accountant Wants You To Use Tax Prep Checklist Small Business Tax Tax Prep

Mortgage Refinance Calculator Excel Spreadsheet Refinance Mortgage Mortgage Refinance Calculator Refinance Loans